Hong Kong seeks to import LNG to cut coal reliance

A floating regasification vessel with 8.3bcm capacity in the works.

Hong Kong is firming up plans to import LNG for the first time, so as to reduce reliance on coal and reduce carbon emissions. In June, Hong Kong Offshore LNG Terminal, a joint-venture between Castle Peak Power Co. (CAPCO), and Hong Kong Electric Co. (HK Electric), announced the signing of an agreement with Japan’s Mitsui O.S.K to charter a Floating Storage Regasification Unit (FSRU) for a duration of 10 years.

The FSRU will be deployed offshore the country’s southern coast, and have the capacity to import 6mtpa (8.3bcm) of LNG. Construction is expected to require investments of up to $640-768m and slated to start by early-2020 with a view to first gas in 2021.

Fitch Solutions noted in a report that the LNG will be sourced from supermajor Royal Dutch Shell's global portfolio, as per a deal reached earlier in the same month. “Specific volumes to be imported are not known, although initial imports are estimated to range between 1.5-2.5mtpa, assuming conservative average utilisation rate of 25-45%,” it said.

Efforts to develop LNG import capabilities in Hong Kong are spearheaded by billionaires Li Ka-Shing, who owns a 33.37% stake in HK Electric via his utility firm Power Asset Holdings, and Michael Kadoorie, owner of the city's biggest electricity firm CLP Group, which holds a 70% stake in CAPCO.

Fitch Solutions noted that HK Electric also boasts ties to Qatar through a 19.9% stake held by state-owned investment vehicle Qatar Investment Authority, which could potentially serve as the foundation for future investment and LNG imports from Qatar.

Hong Kong’s LNG ambition is also in line with its broader national agenda, of gradually phasing out coal in favour of natural gas and non-fossil fuels, it said. The government committed to raise the share of natural gas in the national power mix to 50% by 2020, from 27% in 2015, and to reduce carbon emissions by 65-70% from 2005 levels by 2030, as per its Climate Action Plan to 2030.

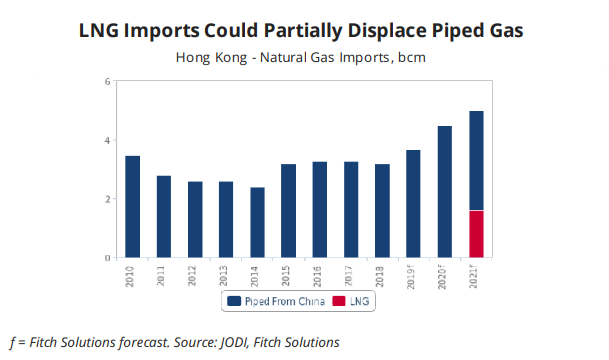

“A more aggressive pivot towards LNG particularly for power generation appears likely for the subsequent quarters, as the heavily coal-dominated sector is responsible for emitting the most emissions, accounting for close to 70% of total annual carbon emissions, even though no new coal plants have been approved since 1996. Any LNG imports would also produce the added benefit of complementing and slowly displacing pipeline gas imports from China, reducing energy security concerns,” Fitch Solutions commented.

Historically more expensive than coal, the current prolonged downturn in spot LNG prices, next to projected ample supply over next few years, makes it more palatable for Hong Kong to partake in LNG trading for the first time, it added. “The wide array of supplies available, coupled with market's embracing of greater flexibility and diverse pricing exposure in LNG contracts, also lowers risk and increases leverage for buyers, such as Hong Kong, during negotiations with suppliers.”

Moreover, soured trade relations between the US and China, and the latter’s shunning of energy imports from the former irrespective of cost, could also act to Hong Kong’s advantage, as uncontracted US LNG cargoes that would otherwise head to China seeks new markets, Fitch Solutions said.

“Many of the aforementioned factors are also driving Asia's other coal-reliant countries to contemplate expanding LNG imports or to develop LNG import capability for the first time, as shown by Myanmar, the Philippines, Vietnam and even Australia set to become first time importers of the fuel within the next five years,” it added.

Advertise

Advertise